NASA Satellites Help Farmers in Central America's Dry Corridor

Unexpected shocks from natural hazards can affect populations throughout the globe, threatening sustainable development and resilience. However, the impacts of these events, such as extreme precipitation or drought, disproportionately affect the developing world where individuals often are not insured and live and work in conditions that leave them vulnerable to natural disasters. This can lead to significant economic and environmental challenges if preventive measures or mitigating measures are not taken in time. To reduce risks from natural disasters and build climate resilience, decision makers are using NASA Earth observations to develop index-based insurance products and protect low-income customers in Central America, especially in the region known as the Dry Corridor.

MiCRO’s payout process depicting actions taken when a disaster strikes: NASA satellite data (1) is used to design payout triggers through a calculation platform (2). When a disaster occurs and depending on its severity, payment is determined (3) and clients are informed via text (4). Credits: MICRO

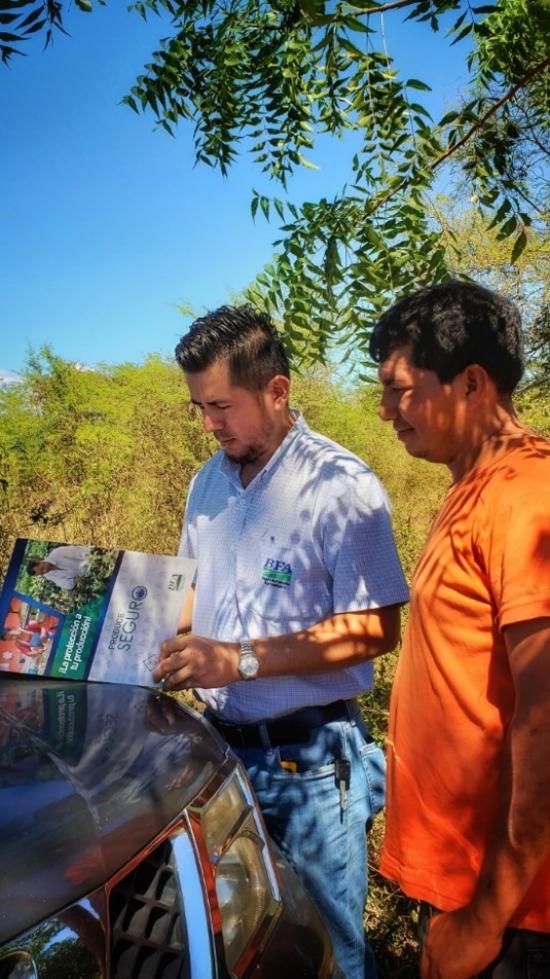

The Microinsurance Catastrophe Risk Organization (MiCRO) is meeting this need. The company has the support of various organizations such as the Swiss Development Agency, KfW Bank, Mercy Corps, and Swiss Re. Using this support, MiCRO has developed comprehensive programs to increase climate resilience of the low-income business owner population of Guatemala, San Salvador, and Colombia. Local partners play a fundamental role in the design and implementations of the solutions. Currently MiCRO is working with Seguros Futuro and Banco de Fomento Agropecuario (BFA) in El Salvador; Banrural and Aseguradora Rural, Seguros Universales, and Seguros Columna in Guatemala; and SBS and Bancamia in Colombia.

MiCRO’s approach is based on a technology platform that provides risk management solutions to deliver tailor-made insurance policies. These policies are designed to protect vulnerable individuals (e.g. subsistence farmers) and small and micro-entrepreneurs against various perils such as excessive rainfall, severe drought, and earthquakes using indexes that are highly correlated to losses in the field. The index (e.g. rainfall levels) is derived using Earth observational data from NASA satellites, providing a cost-effective, efficient and quick way to capture weather-related hazards like droughts, especially where ground data is sparse. As such, the application of historical and real-time data, such as precipitation data from NASA GPM, enables MiCRO to define a weather-related index and approximate actual damages and issue immediate claim payouts directly to its customers when precipitation (or other extreme weather events) exceed pre-determined parameters in a given location. Putting it simply, when an index is triggered, a payout is made, allowing clients to avoid lengthy and unaffordable loss adjustments.

One of the many success stories is that of Mr. Pascual, a maize grower from the department of La Union in El Salvador. Three extreme precipitation events in 2019 were measured in his area using real-time GPM data, triggering payouts for each event. The ability of measuring extreme events using real-time satellite data enabled MiCRO, Seguros Futuro and BFA to provide fast relief and communication of payments to their clients more efficiently. In most cases this can be accomplished via mobile phones. Mario benefits from index-based insurance because it helps him to avoid using savings and selling personal assets when disasters occurred. With the incorporation of NASA Earth observations into such products, MiCRO and its partners have protected over 25,000 individuals throughout Guatemala, San Salvador, and Colombia against disasters and have continued to support these low-income entrepreneurs to be more climate resilient, competitive and improve their standard of living.

Resources:

- GPM Earth Day 2020 Resources

- Download the One-pager Highlight Slide on MICRO (.pptx)

- Precipitation Education:

- Who’s Using GPM Data?

- STEM Interview with Iker Llabres

- Lesson Plans: Water for Wheaties? Freshwater Resources for Agriculture:

- Explore more of the ways in which GPM Data are being used:

Credits:

Text by Andrea Portier (NASA GSFC/SSAI)

Photos and images provided by Microinsurance Catastrophe Risk Organisation (MiCRO)